This post was originally published on this site

Article Source: The financial condition of Idaho agriculture: 2023 | Ag Proud - Ag Proud

Idaho farmgate cash receipts and net farm income held near highs in 2023. Price changes varied greatly across commodities, but improved yields kept overall cash receipts elevated. Increased input costs, particularly interest expenses, led to a moderate decline in net farm income.

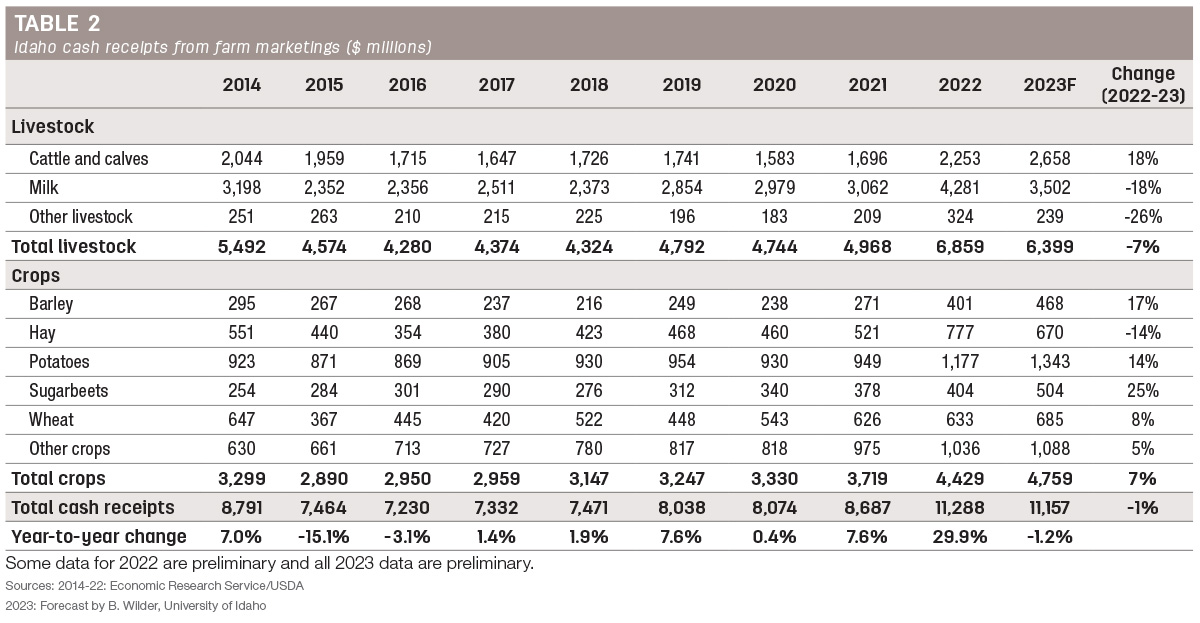

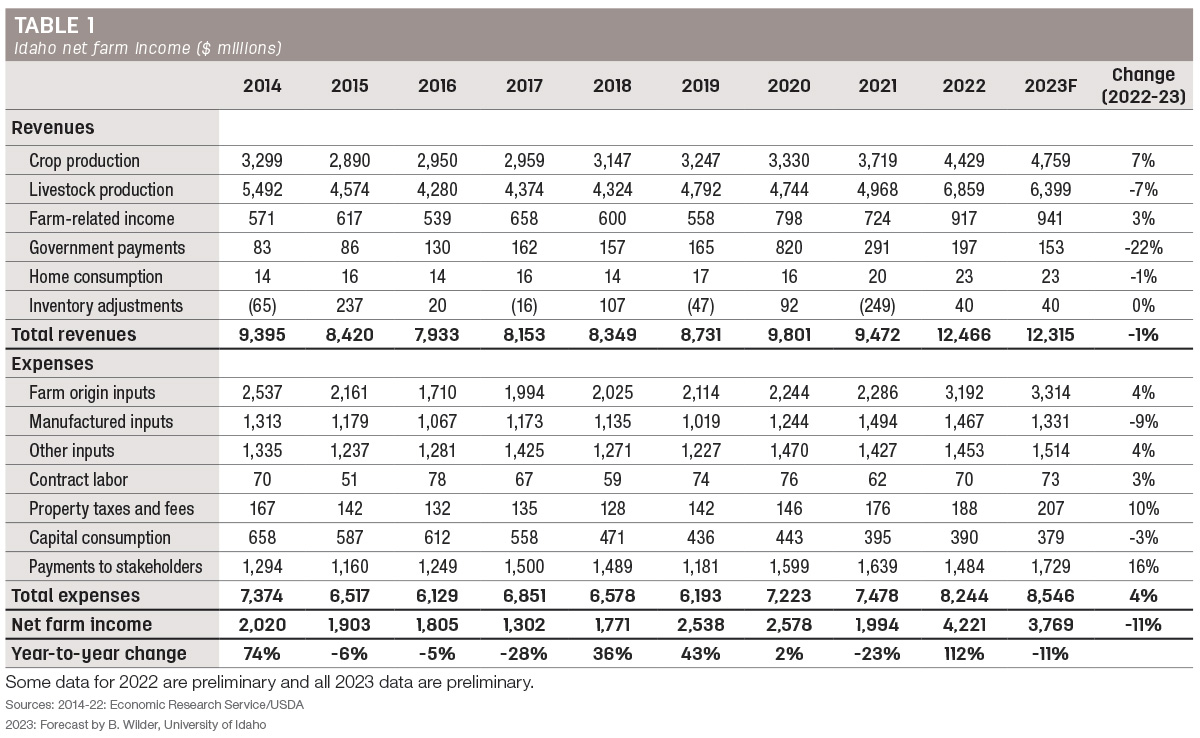

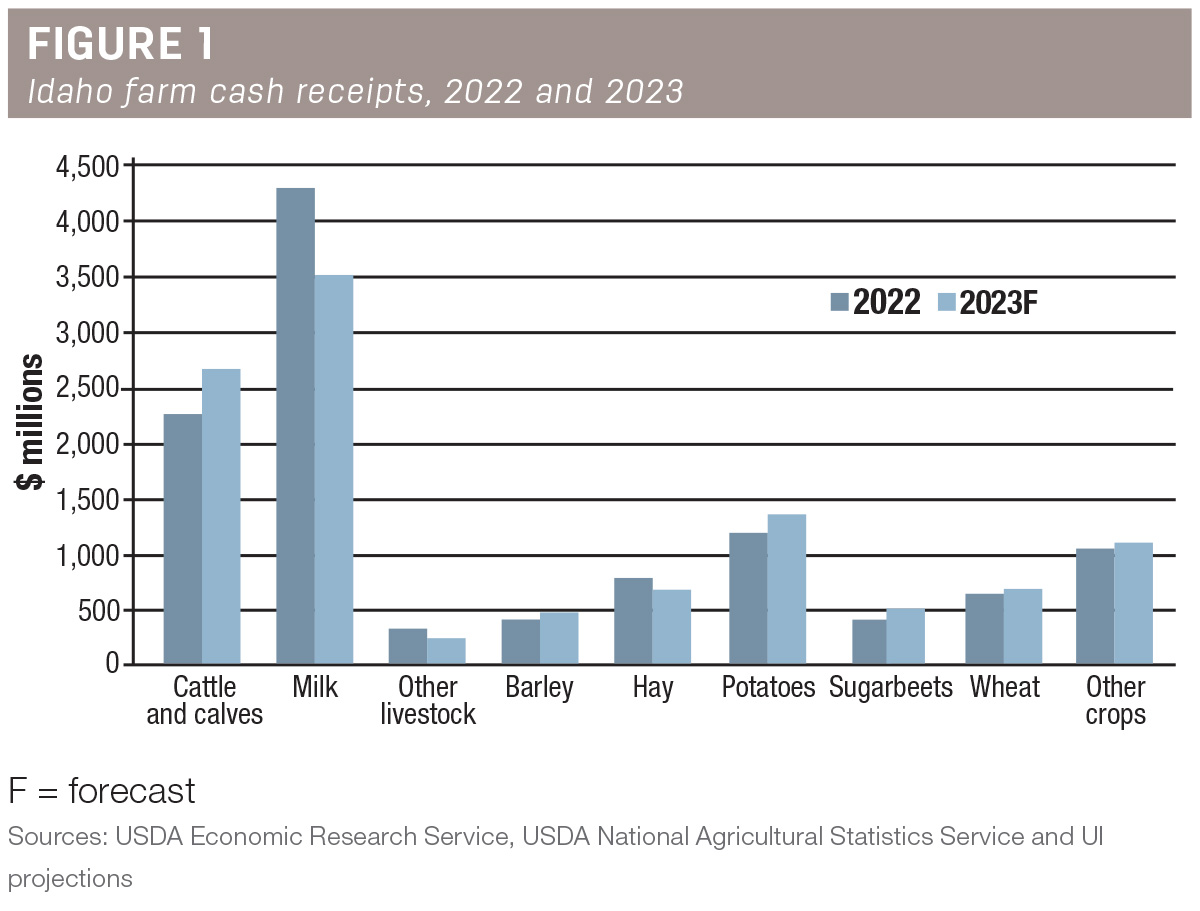

Cash receipts for livestock and crops in 2023 are estimated at $11.2 billion, a 1% decrease over 2022. Cash receipts for milk, Idaho’s leading agricultural commodity, were estimated to be 18% lower than 2022’s. Those for potatoes, Idaho’s highest-revenue crop, were estimated to be 14% higher than 2022’s. Net farm income for 2023 was estimated at $3.8 billion, 11% lower than in 2022 but still 58% above the 10-year average. At $8.5 billion, estimated expenses are expected to reach a record high, up 4% over 2022. Fortunately, strong prices and yields for most commodities should keep a majority of operators in the black.

Highlights

- Exports from farms and food processors create a ripple effect throughout Idaho’s economy, ultimately helping to make agribusiness one of Idaho’s largest industries. About $1 of every $6 in sales is directly or indirectly created by agribusiness.

- Idaho, the top potato producer, is estimated to see another record year, with cash receipts of $1.3 million, up from $1.2 million in 2022.

- Cattle and calves bring in all-time high receipts in 2023 at $2.7 million, up from $2.3 million in 2022.

- Milk sees a modest decline in estimated cash receipts for 2023 of $3.5 million, down from $4.3 billion in 2022. Revenues from milk production remain the highest of all agricultural commodities produced in Idaho.

- Idaho agriculture is driven largely by livestock. Cash receipts from milk, cattle and calves, and other livestock (trout, sheep, etc.) comprise 57% of total agricultural cash receipts for 2023. Hay, silage, feed grains and the byproducts from sugarbeet and potato processing are used as feed for Idaho livestock.

- Except for 2009 – a year of disastrously poor milk prices – livestock cash receipts have surpassed crop cash receipts for every year since 2001. In 2023, livestock cash receipts are estimated to surpass crop cash receipts by more than $1.6 billion.

- Idaho’s net farm income for 2023 is estimated at $3.8 billion, down 11% from 2022’s record high of $4.2 billion.

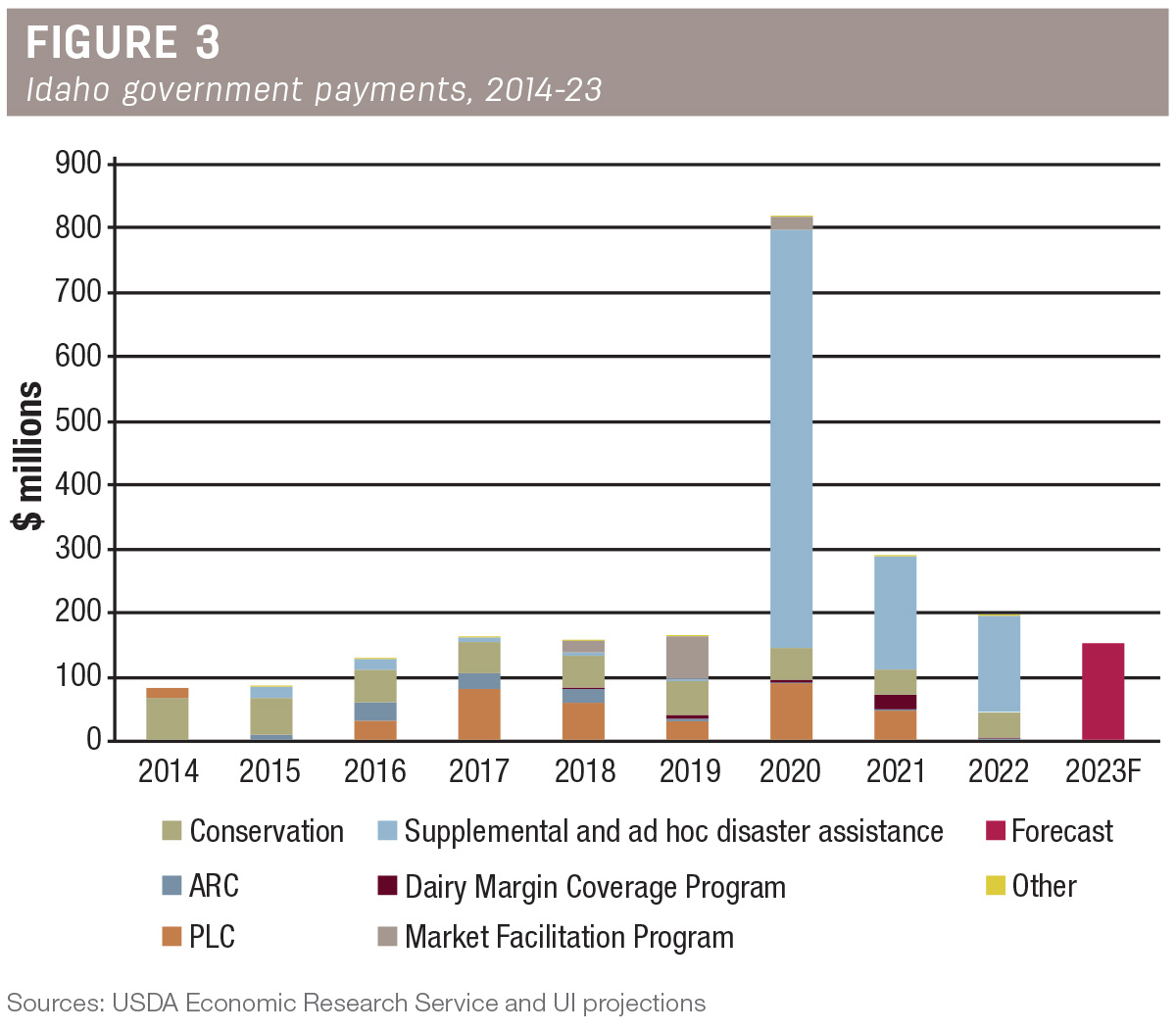

- Federal government payments to Idaho producers in fiscal year 2023 are estimated at $153 million, a decrease of 22% from 2022.

Contribution of agribusiness to Idaho’s economy

Agribusiness is a vertically integrated industry comprising food production and processing. In providing food to national and international markets, agribusiness creates business sales and jobs throughout the Idaho economy and contributes to the state’s gross domestic product (GDP). Agribusiness export dollars ripple throughout Idaho’s economy, creating (directly and indirectly):

- 17% of Idaho’s total economic output

- 12% or 1 in every 8 jobs in the state

- 12.5% of Idaho GDP

Idaho farm cash receipts

Idaho’s 2023 farm cash receipts are estimated at $11.2 billion – just shy of 2022’s record $11.3 billion and 30% over the 10-year average of $8.6 billion.

Crop revenues in 2023 are estimated at $4.8 billion, up 7% from 2022’s $4.4 billion and 37% greater than the 10-year average. Sugarbeets (up 25%), barley (up 17%) and potatoes (up 14%) had the largest increases in cash receipts relative to 2022. Wheat and other crop cash receipts were up 8% and 5%, respectively. Hay receipts are expected to be down 14% from their 2022 record high. Sugarbeet receipts are expected to be at an all-time high thanks to strong regional prices and yields. Potato receipts are expected to record a consecutive all-time high due to early-year strength in open-market potatoes carried over from 2022 and higher average contract prices.

Livestock revenues are estimated at $6.4 billion, down 7% from 2022 but still 26% greater than the 10-year average. Cash receipts from cattle and calves are estimated at $2.7 billion (up 18%), while receipts from other livestock are estimated to be approximately $240 million (down 26%). Milk receipts are the largest component of this category, with projected 2023 cash receipts of $3.5 billion (down 18%).

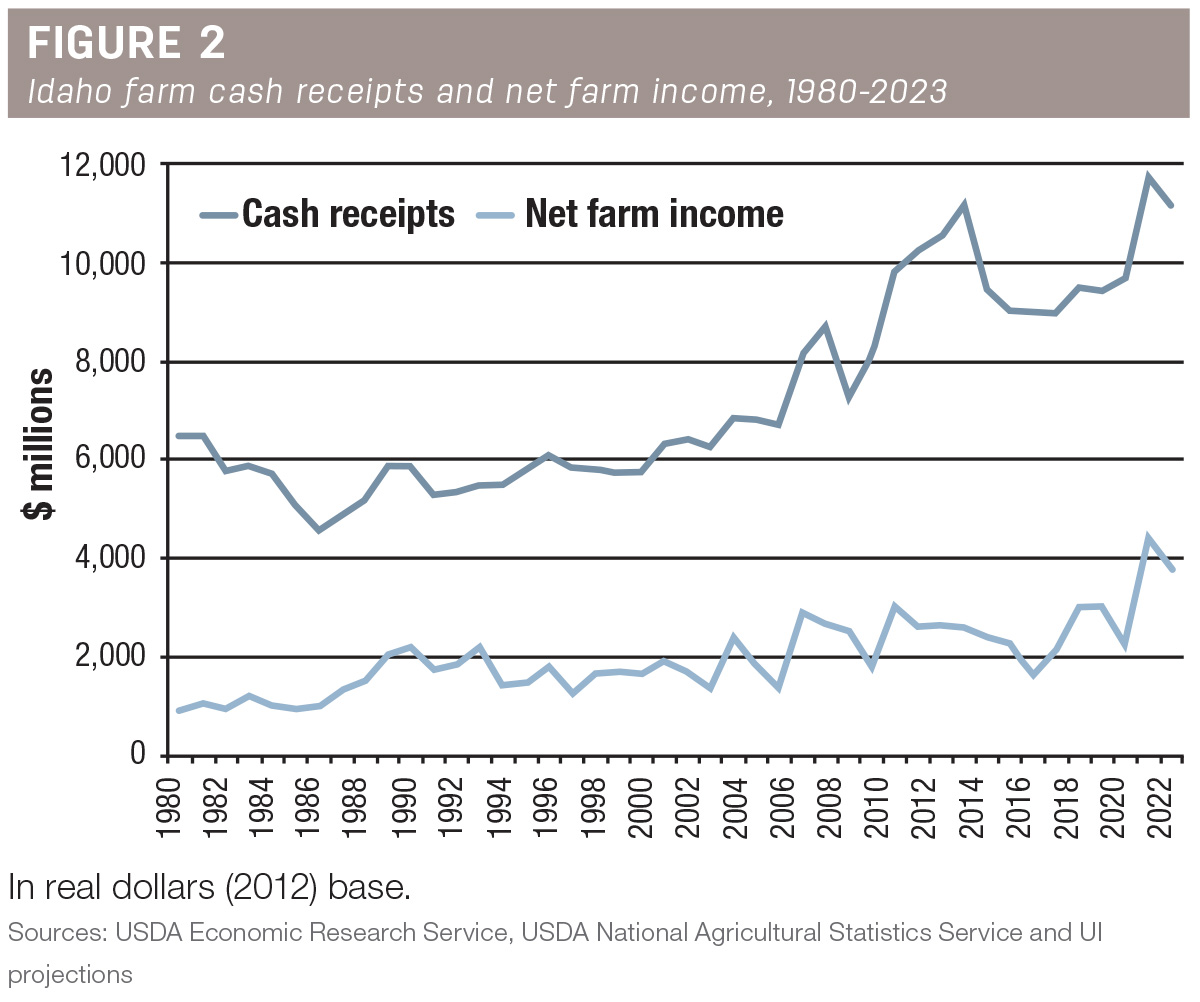

In real dollars (inflation-adjusted to 2017), estimated cash receipts are 53% greater than the 44-year (1980-2023) average. Extreme volatility in commodity prices over the past decade has increased agricultural revenue volatility to levels not seen since the 1970s and 1980s.

Idaho net farm income

Net farm income, revenues minus costs, is the farmer’s bottom line. Revenues include cash receipts from crop and livestock sales, inventory changes, the estimated value of home consumption, government payments, machine hire and custom work, forest product sales and the imputed rental value of farm dwellings. Farm expenses include farm-origin inputs (purchased livestock, feed and seed), manufactured inputs (fertilizers, fuel and electricity) and “other inputs,” including repairs and maintenance, machine hire and custom work, marketing, storage, transportation and contract labor.

The projected 11% decrease in 2023 Idaho net farm income reflects a 1% decrease in total revenues and a 4% increase in total expenses. Net farm income in 2023 is estimated at $3.8 billion, which is 58% greater than the 10-year average. The USDA’s U.S. net farm income estimate for 2023 is $151 billion, down 17% from 2022.

Historically, net farm income is much more volatile than gross cash receipts. In six of the past seven years, Idaho experienced double-digit percentage swings in net farm income. Real-dollar Idaho net farm income (inflation-adjusted to 2017) was the second-highest value in recorded history, with the next highest being in 2022 ($4.4 billion). Idaho’s real net farm income in 2022 is estimated at 92% above the 44-year average (1980-2023).

The modest increase in farm expenses in 2023 is primarily attributed to a 43% increase in interest expense, a 20% increase in livestock and poultry purchases, and only marginal improvements or declines across all other expense categories, ranging from a 14% decline (fuel and oils) to a 10% increase (property tax).

Idaho government payments

Federal government payments to Idaho agriculture in fiscal year 2022 are estimated at $185 million, which is 36% lower than in 2021 but still 42% greater than the average of the five years leading up to 2020. The years 2020 and 2021 are excluded from that average due to COVID-19-related payments. Federal payments are expected to decline or stabilize moving forward. Idaho is estimated to have received around 1% of total 2022 payments to U.S. agriculture.

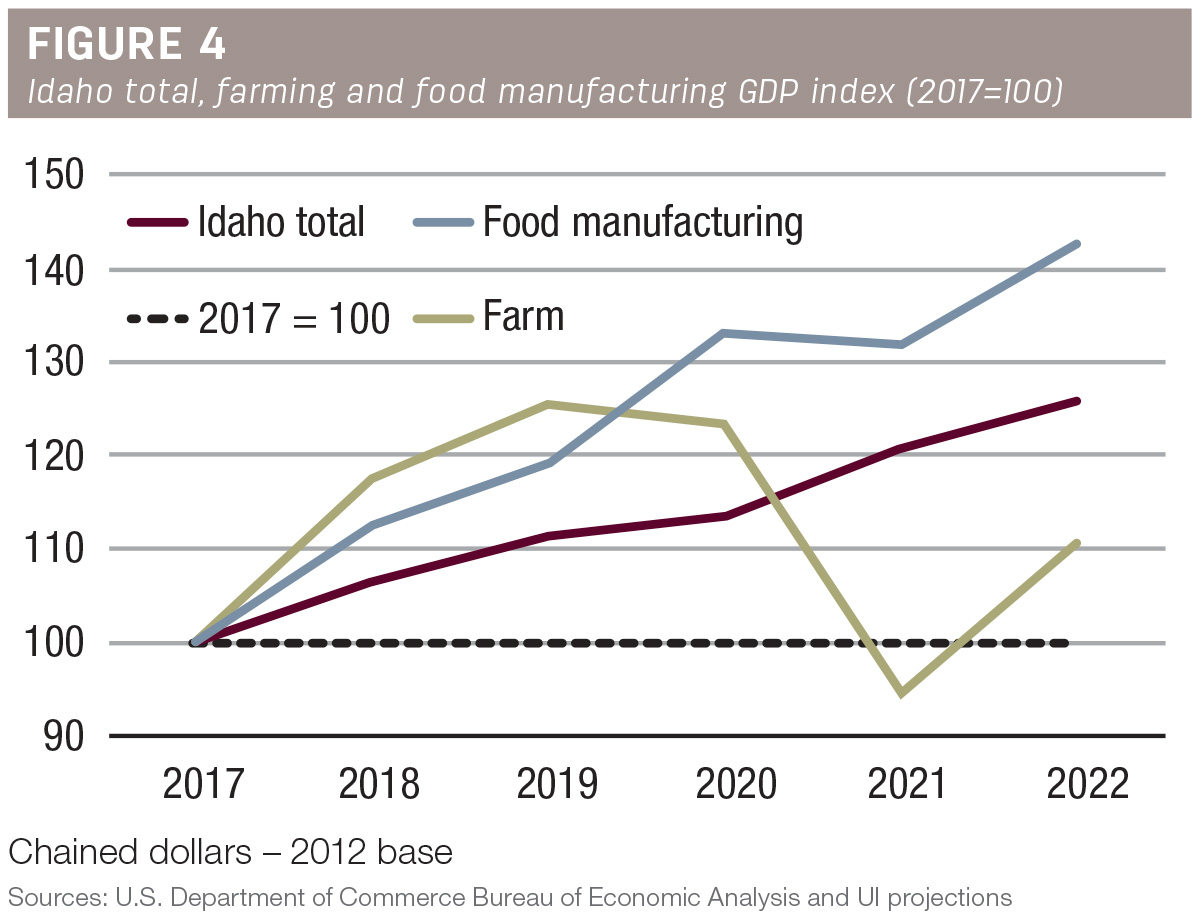

Idaho agriculture’s GDP

Gross domestic product (GDP) measures value added, the value of output minus the value of intermediate goods and services used in production. GDP grows when farms and businesses become more efficient, increasing output while reducing the use of intermediate inputs. In 2023, Idaho’s nominal GDP was approximately $111 billion, of which 4.5% was generated by farming. Nominal farm GDP in 2022 increased 58% to $5.2 billion from $3.3 billion in 2021. It is estimated that final nominal 2023 Idaho farm GDP will be on par with 2022 levels, while 2023 real GDP will see an inflation-related decline. Over the past six years (2017-22), inflation-adjusted (2017 dollars) Idaho GDP has grown over 25%, while Idaho farm GDP increased around 10%.

Idaho livestock and crop revenues

- Cattle and calves – In 2023, revenue from cattle and calves is estimated at $2.7 billion. Most of this increase is attributed to record beef cattle prices. The USDA NASS (National Agricultural Statistics Service) reports that the Idaho beef cow inventory fell 10% from Jan. 1, 2022, (498,000) to Jan. 1, 2023 (449,000). The U.S. beef industry is in a state of contraction – the U.S. beef cow herd is not expected to increase again until 2025 or 2026. Idaho, having recovered from drought sooner than most cattle-producing regions, could begin rebuilding its cow herd as soon as 2024.

- Milk – Softer year-over-year milk prices led to decreased milk revenues of $3.5 billion in 2023, down from $4.3 billion in 2022. Production volumes were up over 1.5% in 2023 compared to 2022. Milk cow inventories in Idaho as of Jan. 1, 2023, were 661,000, which is a 1% increase compared to 2022. Prices received ranged from $18 to $23 per hundredweight (cwt) throughout 2023; on average, this is a 20% decrease from 2022.

- Other livestock – Revenues for other livestock (e.g., trout, sheep, goats, chickens, eggs) are estimated at $239 million, a 26% decrease from 2022. The 55% increase in revenues from 2021 to 2022 was led almost entirely by farm-sold chickens and eggs. While the surge of growth in that industry should make a larger impact moving forward, it is unlikely that chicken and egg sales can sustain their 2022 numbers. Most other livestock categories (sheep, goats, etc.) are expected to show a relatively flat performance from 2022 to 2023.

- Barley – Idaho barley production in 2023 increased by an estimated 540,000 bushels (1%) relative to 2022. Harvested acres were unchanged, but a 1-bushel-per-acre yield increase contributed to the production increase. That modest production increase and a 19% year-over-year increase in prices led to all-time-high barley cash receipts estimated at $468 million – 17% higher than 2022.

- Hay – Hay cash receipts for 2023 are projected to be $670 million, down 14% from all-time highs in 2022. Approximately 45% of the hay produced in Idaho is fed on the farms where it was produced rather than sold. Thus, the total value of hay production is estimated at $1.2 billion in 2023. Idaho hay production in 2023 was estimated at 5.5 billion tons, which is 3% higher than what was produced in 2022. The year-over-year gross sales decline is driven by a 12% decrease in prices.

- Potatoes – With 2023 revenues estimated at $1.3 billion, a 14% increase over 2022, potatoes remain Idaho’s largest cash crop. Planted and harvested acres of 330 million were up 12% from 2022. In addition, yields came in higher year-over-year at 430 cwt per acre, up 20 cwt per acre from 2022. This resulted in an estimated production of 142 million cwt, an 18% year-over-year increase in production. The expectation of a second consecutive year of record-high receipts is driven by high old-crop cash prices, higher reported contract prices for 2023 and higher yields, despite lower prices for open new-crop potatoes.

- Sugarbeets – Sugarbeet yields for 2023 increased over last year’s due primarily to favorable growing conditions. Yields in 2023 averaged 39.4 tons per acre, up from 38.1 tons per acre in 2022. Sugarbeet production for 2022 is projected to be 6.8 million tons. Harvested acres were higher at 173,000 acres in 2023 as opposed to 170,000 acres in 2022. Idaho’s projected 2023 average sugarbeet price of $74 per cwt is 19% higher than the $62 per cwt average received in 2022. Sugarbeet revenues are estimated to be an all-time high of $504 million, 25% higher than 2022.

- Wheat – Wheat is Idaho’s second-largest crop by revenue in 2023. Wheat revenues for 2023 are expected to be $685 million, up $52 million (an 8% increase) over 2022. Harvested acres declined 4% to 1,035 million acres and yields decreased 1% year over year to 86 bushels per acre, leading to an overall 5% production decline to 89 million bushels. Prices also fell 8% from 2022 to 2023, on average. Higher projected year-over-year cash receipts are related primarily to the timing of sales as reported by the USDA NASS.